History will be quick to point out that most of humankind’s noteworthy journeys ever did in fact encounter a diversion or two along the way. And, what a spectacular trek it’s been for Bitcoin this far. Continue reading to see why the world’s number one cryptocurrency arrived at a hard fork on its path recently. Also, what the outcome of this notable event was and the way forward from here is.

But first…a little history

Hard fork involves the concepts of blockchain and Bitcoin mining, therefore a quick recap on these topics should help us grasp recent developments better.

When the mysterious Satoshi Nakamoto invented Bitcoin in 2009, blockchain was included in the design. It represents the operating system that underlies the borderless digital currency, which exists completely outside of traditional (fiat) banking structures.

All Bitcoin transactions on the planet flow through its blockchain “spinal cord”, where they’re tracked & registered on a collective record, called the distributed or decentralised ledger. Simply put, this accounting system spreads over a vast network of computers around the globe.

The people and their technology who keep the decentralised ledger checked and balanced, are called Bitcoin miners. They are also rewarded in the cryptocurrency for their services.

Okay, I get it. So, when did the Bitcoin hard fork occur and what’s different now?

On 1 August 2017, a second blockchain appeared to the original Bitcoin one. The event is called a hard fork because it compares to a single path offering two alternative routes after the road has forked. Previously, there was only Bitcoin (BTC). Now, we have Bitcoin (BTC) and Bitcoin Cash (BCH).

Why did Bitcoin split?

The short answer is that existing structures could not keep up with the ever-increasing demand for Bitcoin. The situation led to a slowdown in transactions, causing delays, which severely hampered Bitcoin’s continuous rise.

The backlog was caused by Bitcoin’s original code only allowing a pre-set, limited amount of transactions to be processed in any of the blocks making up the blockchain. In earlier days, the smaller block sizes posed no problem, because the demand for Bitcoins was still busy ramping up. However, as of late, a grander scale was required to handle the meteoric trade levels.

Although it did become abundantly clear to most stakeholders in the Bitcoin community that an urgent solution was needed to speed up production of the virtual currency, there was a major disagreement on how to achieve the required outcome. Popularly referred to as the “scaling debate”, two major camps on the issue evolved among Bitcoin miners.

One fraction of miners supported the “BIP 91” solution. It aimed at freeing up space within existing blocks (raising the 1MB transaction limit to 2MB), by moving some of the data outside the blockchain to an area called “SegWit”, which is short for “segregated witness.”

The second camp of miners rejected BIP 91 as it would reduce their mining fees earned, also, they said, increase the transaction size by too little. Instead, they made a counter-offer. Quite simply, this entailed the start of a second blockchain for Bitcoin, with larger block sizes (8MB transaction limit) that can store much more data, leading to significantly faster processing times.

The voting time came and resulted in the birth of the second Bitcoin blockchain i.e. Bitcoin Cash (BCH).

How does the Bitcoin hard fork affect me?

Simply by looking at the hard facts, history and forecast, we believe that now is a perfect time to stock up on your Bitcoins.

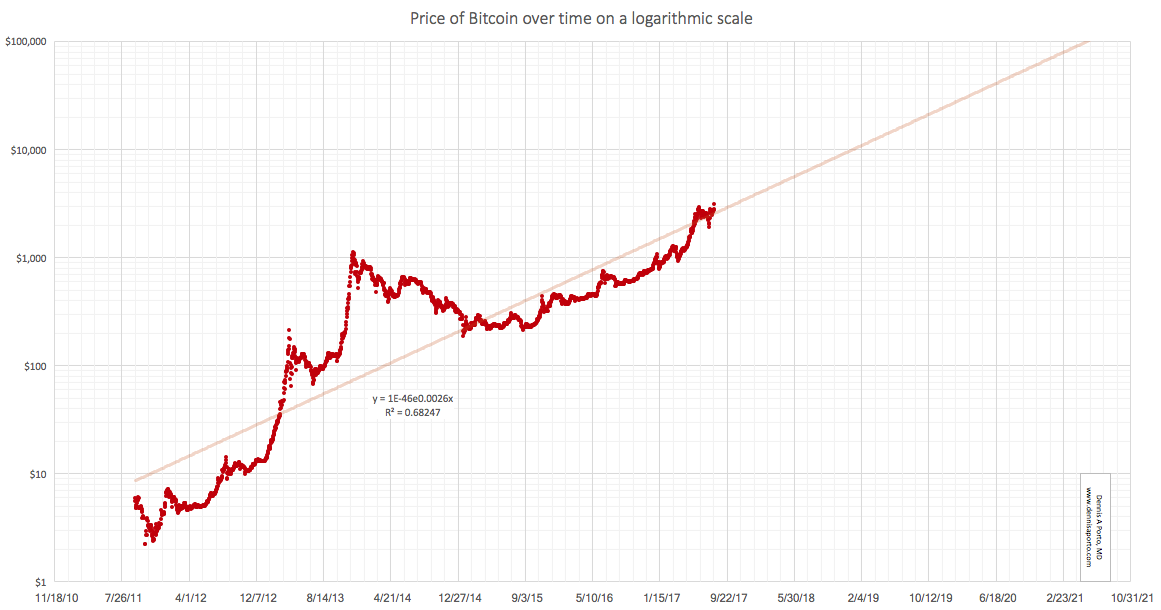

The above graph indicates a strong, sustained, upward trend in the price of Bitcoin, which is currently traded around $4,400.

Renowned Harvard University academic, Denis Porto, has recently remarked that “since Bitcoin’s inception, its price has doubled every eight months.” He also believes that, if the Bitcoin price continues to compound exponentially, the way it has done, then it has the potential to reach $100,000 by the year 2021.

Where can I purchase my Bitcoin?

The market is now overcrowded with different exchanges, offering a wide range of cryptocurrency trading services. Not surprisingly, the customers are facing a difficult choice over what exchange to use as a safe haven for their money.

CEX.IO is the Bitcoin Exchange you can trust. Unlike many exchanges that are popping up and abruptly vanishing, UK-based CEX.IO has a long-standing reputation as it was established way back in 2013. Since then CEX.IO has acquired the MSB (Money Services Business) status in FinCEN and become fully compliant with all necessary regulations and standards imposed upon any legal entity.

As a market leader, CEX.IO makes every effort to ensure positive experience for their customers and facilitate cryptocurrency trading on their platform. With the introduction of a credit card payment option CEX.IO made cryptocurrency deposits and withdrawals easy and fast from almost everywhere in the world. As of today, the customers are welcome to use VISA, MasterCard and bank transfers to buy and sell Bitcoin and other cryptocurrency at the most favorable rate.

In addition to Bitcoin and Ether CEX.IO has recently launched Bitcoin Cash support on their website and offers Bitcoin Cash trading for BTC, USD, EUR and GBP with a view to further expanding the Bitcoin Cash market and launching margin trading.